Unbundling the Bundle: Texas’s New Anti-Tying Law in Home Insurance

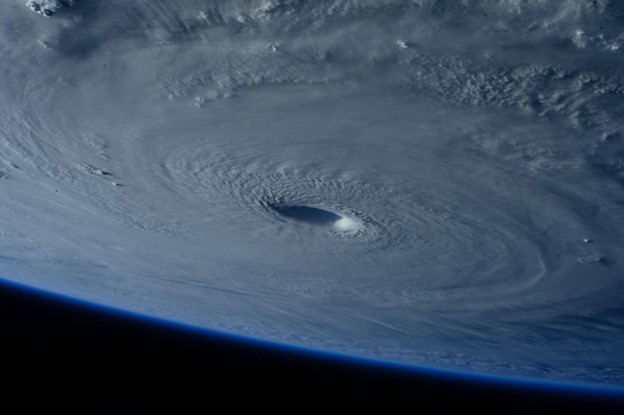

Introduction In the vast landscape of Texas, where sprawling ranches meet bustling urban centers, homeownership comes with its unique set of challenges and protections. The Lone Star State is no stranger to extreme weather, from hurricanes along the Gulf Coast to hailstorms in the Panhandle, making home insurance not just a luxury but a necessity […]

Unbundling the Bundle: Texas’s New Anti-Tying Law in Home Insurance Read More »