Unbundling the Bundle: Texas’s New Anti-Tying Law in Home Insurance

Introduction In the vast landscape of Texas, where sprawling ranches meet bustling urban centers, homeownership comes with its unique set of challenges and protections. The

Introduction In the vast landscape of Texas, where sprawling ranches meet bustling urban centers, homeownership comes with its unique set of challenges and protections. The

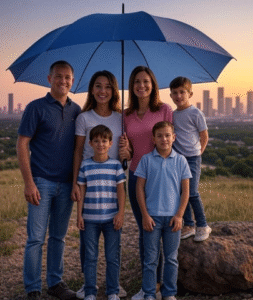

Umbrella insurance acts as a safety net, offering extra liability coverage that kicks in once your standard policies—like home, auto, or boat insurance—reach their limits.

When it comes to protecting your home and vehicle, securing the right insurance coverage is essential. Bundling auto and renters insurance can offer both convenience

When your living situation evolves, it’s crucial to ensure that your homeowners insurance policy remains aligned with your current needs. One of the first steps

Many home insurance policies cover air conditioners but each policy varies. Personal ACs are also covered for renters. However, AC units must be affected by a peril that is covered by your policy for reimbursement. You’ll need a home warranty for wear and tear. If your insurance carrier doesn’t accept your claim, there are steps you can take for legitimate disputes to rectify this issue. It’s important to review your coverage annually to avoid coverage gaps.

While home insurance may cover damage caused by your water heater and its replacement, you’ll need to meet certain criteria and have the right coverage in place for protection. Many water heaters can benefit from appliance insurance, also known as a home warranty. There is also coverage available for oil tank leakage, however, you must add a specific endorsement and have an inspection certificate to do so.

Covering your home, vehicle, and personal belongings from tornado damage is possible through insurance. Although some homeowners in Texas may need additional coverage, standard home insurance policies protect against tornado damage and windstorms. Comparing the coverage options near you will yield the best results for your protection and budget.

Auto insurance rates are determined by a complex array of factors, ranging from the driver’s age and driving history to the type of vehicle and

Lease gap insurance can help you protect against potential losses after a vehicle is totaled or stolen. Unlike other states, Texas has laws limiting the cost of gap insurance on lease and the terms in which coverage can be offered. Understanding whether or not gap coverage is right for you is important and comparing quotes can help you find affordable, reliable protection that meets your needs and budget.

If you want to protect your jewelry from being damaged, stolen, or lost, you have plenty of options. Jewelry insurance is a great way to ensure your collection has the proper coverage limits that other forms of property insurance don’t provide. You should compare different types of coverage and jewelry insurance companies to find the best option at the lowest price available. Sometimes, carriers may undergo an investigation to be sure a claim is legitimate. If you own jewelry and wish to keep your items covered, be sure to get your items appraised for the best protection regularly.

We are dedicated to providing comprehensive insurance solutions tailored to your unique needs.

3861 Long Prairie Rd Ste 101, Flower Mound, TX 75028

Phone: 800-875-4711

© 2023 Insurance. All Rights Reserved.